TNPSC Indian Economy – Goods and Services Tax:

Indian Economics questions are more important for the TNPSC Group 2 Prelims Exam. You will get 6 t0 8 marks from that Indian Economy portion. On this page, TNPSC Group 2, 2a, and Group 4 TNPSC Indian Economy Study Materials questions with answers are uploaded. Go through TNPSC Indian Economy Notes, Questions, and Answers below for the prelims exam.

Students who are preparing for the Group exam concentrate more on the maths part. you will easily score more marks in the Economics part. For students’ benefit, we upload TNPSC Indian Economy English and Tamil questions and answers in PDF for download. TNPSC aspirants can download and use it for the group prelims exam. kindly download TNPSC Indian Economy PDF given below:

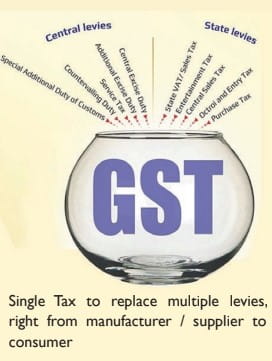

GST (Goods and Service Tax):

- GST is an Indirect Tax that has replaced many Indirect Taxes in India. The Goods and Service Tax Act was passed in Parliament on 29th March 2017. The Act came into effect on 1st July 2017; Goods & Services Tax in India is a comprehensive, multi-stage, destination-based tax that is levied on every value addition.

- In simple words, Goods and Service Tax (GST) is an indirect tax levied on the supply of goods and services. This law has replaced many indirect tax laws that previously existed in India.

- GST is one indirect tax for the entire country.

- Under the GST regime, the tax will be levied at the final point of sale. In the case of intra-state sales, Central GST and State GST will be charged. Inter-state sales will be chargeable to Integrated GST.

Destination Based:

- Consider goods manufactured in Tamil Nadu and are sold to the final consumer in Karnataka. Since Goods & Service Tax is levied at the point of consumption, in this case, Karnataka, the entire tax revenue will go to Karnataka and not Tamil Nadu.

Components of GST:

The component of GST are of 3 types. They are: CGST, SGST & IGST.

- CGST: Collected by the Central Government on an intra-state sale (Eg: Within state/ union territory)

- SGST: Collected by the State Government on an intra-state sale (Eg: Within state/ union territory)

- IGST: Collected by the Central Government for inter-state sale (Eg: Maharashtra to Tamil Nadu)

In most cases, the tax structure under the new regime will be as follows:

| Transaction | New Regime | Old Regime | |

|---|---|---|---|

| Sale within the State | CGST + SGST | VAT + Central Excise/Service tax | Revenue will be shared equally between the Centre and the State |

| Sale to another State | IGST | Central Sales Tax + Excise/Service Tax | There will only be one type of tax (central) in the case of inter-state sales. The Center will then share the IGST revenue based on the destination of goods. |

Nature of Sales tax, VAT, and GST:

- Sales tax was multipoint tax with cascading effect.

- VAT was multipoint tax without cascading effect.

- GST is one point tax without cascading effect.

Advantages of GST:

- GST will mainly remove the cascading effect on the sale of goods and services. Removal of cascading effect will directly impact the cost of goods. Since the tax on tax is eliminated in this regime, the cost of goods decreases.

- GST is also mainly technologically driven. All activities like registration, return filing, application for a refund, and response to notice need to be done online on the GST Portal. This will speed up the processes.