TNPSC Indian Economy – Source of Revenue:

Indian Economics questions are more important for the TNPSC Group 2 Prelims Exam. You will get 6 t0 8 marks from that Indian Economy portion. On this page, TNPSC Group 2, 2a, and Group 4 TNPSC Indian Economy Study Materials questions with answers are uploaded. Go through TNPSC Indian Economy Notes, Questions, and Answers below for the prelims exam.

Students who are preparing for the Group exam concentrate more on the maths part. you will easily score more marks in the Economics part. For students’ benefit, we upload TNPSC Indian Economy English and Tamil questions and answers in PDF for download. TNPSC aspirants can download and use it for the group prelims exam. kindly download TNPSC Indian Economy PDF given below:

Gross Domestic Product (GDP):

- GDP is the total market value of final goods and services produced within the country during a year. This is calculated at market prices and is known as GDP at market prices.

- GDP by expenditure method at market prices = C + I + G + (X – M)

GNP:

- The total money value of final goods and services produced in a country during a particular year (one year) including depreciation and net exports.

- GNP at Market Prices = GDP at Market Prices + Net Factor Income from Abroad.

NNP :

- The total money value of final goods and services produced in a country during a particular year (one year) excluding depreciation including net exports.

- NNP = GNP – depreciation allowance.

NNP at Factor cost:

- The total income payment is made to factors of production.

- NNP at factor cost = NNP at Market prices – Indirect taxes + Subsidies.

Personal Income:

- Total income received by the individuals of a country before payment of direct taxes.

- Personal Income = National Income – (Social Security Contribution and undistributed corporate profits) + Transfer payments.

Disposable income:

- It is the sum of the consumption and saving of individuals after the payment of income tax.

- Disposable Income = Personal income – Direct Tax. As the entire disposable income is not spent on consumption, Disposal income = consumption + saving.

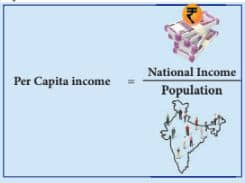

Per capita income :

Social Accounts:

The accounts of national income consider the social cost generated by economic activities.

Unpaid services:

Rendering useful services like preparation of meals, washing, leaning, bringing up children, services to their friends and relatives without payment

Capital sector:

It includes saving and investment activities.

Transfer payments :

Government makes payments in the form of pensions unemployment allowance, subsidies, etc.

TNPSC Reserve Bank of India Questions and Answers:

Multiple choice questions:

1. Net National Product at factor cost is also known as

(a) National Income (b) Domestic Income (c) Per capita Income (d) Salary.

2. Primary sector is …………………..

(a) Industry (b) Trade (c) Agriculture (d) Construction.

3. National income is measured by using ……….. methods.

(a) Two (b) Three (c) Five (d) Four

4. Income method is measured by summing up all forms of ……………

(a) Revenue (b) Taxes (c) expenditure (d) Income

5. Which is the largest figure?

(a) Disposable income (b) Personal Income (c) NNP (d) GNP

6. Expenditure method is used to estimate national income in …………..

(a) Construction sector (b) Agricultural Sector (c) Service sector (d) Banking sector

7. Tertiary sector is also called as ………. sector.

(a) Service (b) Income (c) Industrial (d) Production

8. National income is a measure of the ……… performance of an economy.

(a) Industrial (b) Agricultural (c) Economic (d) Consumption

9. Per capita income is obtained by dividing the National income by …………

(a) Production (b) Population of a country (c) Expenditure (d) GNP

10. GNP = ………. + Net factor income from abroad.

(a) NNP (b) NDP (c) GDP (d) Personal income

11. NNP stands for ……….

(a) Net National Product (b) National Net product (c) National Net Provident (d) Net National Provident

12. ……… is deducted from gross value to get the net value.

(a) Income (b) Depreciation (c) Expenditure (d) Value of final goods

13. The financial year in India is ……

(a) April 1 to March 31 (b) March 1 to April 30 (c) March 1 to March 16 (d) January 1 to December 31

14. When net factor income from abroad is deducted from NNP, the net value is …….

(a) Gross National Product (b) Disposable Income (c) Net Domestic Product (d) Personal Income

15. The value of NNP at the production point is called ……

(a) NNP at factor cost (b) NNP at market cost (c) GNP at factor cost (d) Per capita income

16. The average income of the country is _____

(a) Personal Income (b) Per capita income (c) Inflation Rate (d) Disposal Income

17. The value of national income adjusted for inflation is called ____

(a) Inflation Rate (b) Disposal Income (c) GNP (d) Real national income

18. Which is a flow concept?

(a) Number of shirts (b) Total wealth (c) Monthly income (d) Money supply

19. PQLI is the indicator of ………………

(a) Economic growth (b) Economic welfare (c) Economic progress (d) Economic development

20. The largest proportion of national income comes from …….

(a) Private sector (b) Local sector (c) Public sector (d) None of the above